Cardente Real Estate Featured Listings & Transactions - August 10, 2021

Southern Maine’s commercial real estate market - A look back and now

In early February of 2020, I wrote an article stating that “While several sectors may see a slight uptick in va- cancy rates, the leasing market should remain competitive... through year end 2020.” Several months later, the world found itself in the midst of a pandemic and my forecast was wrong. No one could have predicted the global health crisis that would follow for the next 1 1⁄2 years. However, even during the complete shutdown, there remained demand for commercial real

estate in the Southern Maine market; it just depended on the type of use. In the spring of 2020, Federal Express executed a long-term lease for their 34,000 s/f distribution facility in Portland. Without distribution, people staying at home wouldn’t receive packages. Manufacturing facilities required commercial space for pro- duction. Those grocery and full-ser- vice retailers that remained open, still needed a physical structure to house and sell their product. Hospitals, pharmacies, banks, post offices, and many other types of uses, all needed a commercial footprint even during the pandemic.

to read the full article, please go to the attached.

PREMIER PORTLAND SITE JUST LISTED FOR SALE

Cardente Real Estate is pleased to offer for sale / ground lease this premier property located just off I-295 on the corner of Franklin Arterial, Fox Street, and North Boyd Street. Consisting of two contiguous lots totaling 1.03 +/- acres, 129-139 Fox Street offers a level site that is ideal for redevelopment plus, a 6,112 +/- square foot flex / office building with ample onsite parking. One of the last development sites on the Peninsula, amenities include unbeatable accessibility (seconds from I-295 & Marginal Way), highly visible signage, and mainstream exposure on some of the busiest streets in Portland. This is an ideal location for all types of users looking for one of the most signature locations Portland has to offer. For further information, please click below for brochure.

Purchase Requirements - August 2, 2021

Edward Jones Leases at 19 Northbrook Drive in Falmouth, Maine

https://www.edwardjones.com/us-en/financial-advisor/amanda-stetson

Cardente Real Estate's Latest Commercial Leasing Transactions

Learning With Fun has leased 3,000 +/- square feet of commercial space from 25 NexGen, LLC at 25 Yarmouth Crossing Drive, Yarmouth, Maine. This transaction was brokered by Matthew Cardente of Cardente Real Estate.

Johnson Paint, Inc. has leased 4,920+/- square feet of retail space from 412 US Route One, LLC at 412 US Route One, Yarmouth, Maine. This transaction was brokered by Matthew Cardente of Cardente Real Estate.

Eric Dube has leased 1,500 +/- square feet of office space from 189 Main Street Associates, LLC at 189 Main Street, Yarmouth, Maine. This transaction was brokered by Matthew Cardente of Cardente Real Estate.

Primo Glass has leased 1,200 +/- square feet of retail space from M.Thomas/KFIVE, LLC at 103 Pleasant Street, Brunswick, Maine. This transaction was brokered by Matthew Cardente of Cardente Real Estate.

FOR MORE INFORMATION ON THESE TRANSACTIONS OR OUR OTHER LISTINGS, PLEASE CONTACT CARDENTE REAL ESTATE AT 207-775-7363.

Cardente Real Estate Featured Listings & Transactions

Cardente Real Estate Featured Listings- March 18th, 2021

NEW LEASE LISTING | 25 Yarmouth Crossing | 3,000 +- SF Single Story Freestanding Commercial Building

Cardente Real Estate is pleased to offer for lease this 3,000 +/- square foot single story freestanding commercial building located at 25 Yarmouth Crossing in Yarmouth, Maine. Located in the Village just off of Main Street, the demised premises includes an open area currently used for production, a showroom, a meeting room, a corner office, plumbed room with sink and floor drain, two bathrooms, storage and much more. With up to 10 parking spaces, 25 Yarmouth Crossing offers a driveway in the back of the building that provides delivery access to a double door entrance. Other amenities include a freestanding storage shed, multiple egress points around the building, outdoor areas for green space, signage on Main Street pylon as well as by building, and a sheik interior design. Just minutes from US Route One and I-295, this is an ideal location for general business, flex, production, and other commercial uses.

Click here to view: https://conta.cc/392QFlX

Carente Real Estate Transacts 25 Winter Green Way in Brewer, Maine

Cardente Real Estate is pleased to announce that 25 Wintergreen Way in Brewer, Maine a single family home sold to The Morrison Center by Stephen Grant Dirksen and Thitnu Wai Dirksen, for $400,000. This transaction was brokered on behalf of Greg Perry of Cardente Real Estate, and by Jennifer Cammack of NextHome Experience.

Steward Partners Holdings, LLC Leases 8,488 +/- SF of Class A Office at 145 Maplewood Avenue in Portsmouth

Cardente Real Estate is pleased to announce that Steward Partners Holdings, LLC has leased 8,488 +/- square feet of Class A office space located at 145 Maplewood Avenue in Portsmouth, New Hampshire. This transaction was brokered on behalf of the Tenant by Demetri Koutrouvelis & the Savills Inc. team and Matthew D. Cardente. The Landlord, 145 Maplewood Ave LLC, was represented by Margaret O’Brien of Bow Street, LLC.

NEW SALE LISTING SPOTLIGHT: Freestanding Portland Peninsula Commercial Building On Visible Corner

Cardente Real Estate is pleased to offer for sale/lease 34 Portland Street located in Portland, Maine. This freestanding building consists of 3,724+/- square feet with two main floors plus attic with windows and basement area. The prior set up was a community hub with an in-house coffee shop, bar and library. Other amenities include back driveway for loading access and several employee parking spaces, usable storage/flex in basement and top level, and open layouts on main level and second floor; each with a footprint of 1,064 +/- square feet. Located on the corner of Portland Street and Alder Street, this brick building offers unbeatable exposure and great signage opportunities. This would be an ideal location for an owner/occupant, retailer, restaurateur or general business.

For more details about this listing please contact Matt@cardente.com

CARDENTE REAL ESTATE FEATURED LISTINGS- DECEMBER 3, 2020

Cardente Real Estate Transacts 3,000 +/- Square Foot Lease to BamBam Bakery

Cardente Real Estate Reps Maine Needs In Lease in Portland

Cardente Real Estate is pleased to announce that Maine Needs has leased

1,960+/- SF of retail space located at 332 Forest Avenue, Portland, Maine. This

transaction was brokered by Katelyn Rice of Cardente Real Estate and Katie

Allen of Dunham Group which closed October 16, 2020. Maine Needs is a

grassroot nonprofit, powered by a growing collective of volunteers. Noted as an

official 501c3 in October, they strive to help individuals and families in Maine help

meet their basic, material needs by providing donated clothing, hygiene products,

household items, and other necessities. Partnering with Maine schools,

caseworkers, nurses and other nonprofits, Maine Needs is a community effort to

make a difference during these unprecedented times.

https://www.maineneeds.com

NEW LISTING SPOTLIGHT: HIGH END MEDICAL OFFICE/OFFICE CONDO IN PORTLAND FOR SALE

Cardente Real Estate is pleased to offer for sale this 3,045 +/- square foot medical office / office condominium located at 535 Ocean Avenue in Portland, Maine. Completely renovated over the last several years, this unit offers a large open waiting room adjacent to large reception with built-ins & glass slider, nine exam rooms with plumbing, six private offices, a full kitchen, bathrooms (including handicap accessible bathroom), and high end finishes throughout. Other amenities include speciality flooring, wired WiFi hot spots and speakers in ceiling, ample onsite parking, deeded elevator access from adjacent structure, and potential to add an elevator within room built originally for an elevator shaft. This is a must see for any medical office looking for a turnkey set up, all general businesses owner occupants, and investors. Condo is also available for lease.

For further details contact Matt@cardente.com

NEW LISTING SPOTLIGHT: One Unit Remaining at Yarmouth's Landmark Sparhawk Mill

Cardente Real Estate is pleased to offer for lease two premier professional office/ general business spaces at the Sparhawk Mill located in Yarmouth, Maine. Built in 1857 by the Royal River Manufacturing Company, the Sparhawk Mill is truly a landmark property. Situated right on the Royal River, this four-story historic building has undergone extensive renovations. During the property’s redevelopment into office space suites, the owner was careful to preserve the property’s character and historic features including the hardwood floors and the famous bell tower. Amenities include newly paved ample on-site parking, amazing views of the Royal River, easy interior & exterior egress, and direct access to US Route 1 and I-295. Located in the Village of Yarmouth, the Sparhawk Mill is within walking distance to many restaurants and shops as well as paths that run adjacent to the Royal River & Park.

For further details contact Matt@cardente.com

NEW LISTING SPOTLIGHT: Freestanding Portland Peninsula Commercial Building On Visible Corner

Cardente Real Estate is pleased to offer for lease 34 Portland Street located in Portland, Maine. This freestanding building consists of 3,724+/- square feet with two main floors plus attic with windows and basement area. The prior set up was a community hub with an in-house coffee shop, bar and library. Other amenities include back driveway for loading access and several employee parking spaces, usable storage/flex in basement and top level, and open layouts on main level and second floor; each with a footprint of 1,064 +/- square feet. Located on the corner of Portland Street and Alder Street, this brick building offers unbeatable exposure and great signage opportunities. This would be an ideal location for a retailer, restaurateur or general business.

For more information contact Matt@cardente.com

NEW LISTING SPOTLIGHT: Two Unit Commercial Owner/ User Investment Property

Cardente Real Estate is pleased to offer for sale this two unit commercial property location on the highly visible corner of 114 Hancock Street & Route 2 in Rumford, Maine. Recently renovated, the Hancock Street unit is currently a doggy day care & the lower unit off of Route 2 is an Engine Repair shop with an 8 foot loading door & mechanic pit. Amenities include an open layout on the main floor, exterior staircase between both units, onsite parking, highly visible facade & pylon signage, and mainstream exposure. 114 Hancock Street offers high traffic counts in the heart of downtown and is within minutes of Route 2. This is an ideal property for owner occupants & investors.

For more details please contact Matt@cardente.com

CARDENTE REAL ESTATE FEATURED LISTINGS- OCTOBER 8, 2020

FREESTANDING PORTLAND PENINSULA COMMERCIAL BUILDING ON VISIBLE CORNER

Cardente Real Estate is pleased to offer for lease 34 Portland Street located in Portland, Maine. This freestanding building consists of 3,724+/- square feet with two main floors plus attic with windows and basement area. The prior set up was a community hub with an in-house coffee shop, bar and library. Other amenities include back driveway for loading access and several employee parking spaces, usable storage/flex in basement and top level, and open layouts on main level and second floor; each with a footprint of 1,064 +/- square feet. Located on the corner of Portland Street and Alder Street, this brick building offers unbeatable exposure and great signage opportunities. This would be an ideal location for a retailer, restaurateur or general business.

CARDENTE REAL ESTATE FEATURED LISTINGS- SEPTEMBER 18, 2020

TWO UNIT COMMERCIAL OWNER/USER INVESTMENT PROPERTY IN RUMFORD MAINE

1,549-1,971+/- SF OF PREMIER OFFICE/GENERAL BUSINESS SPACE NOW AVAILABLE FOR LEASE AT SPARHAWK MILL IN YARMOUTH

Cardente Real Estate is pleased to offer for lease two premier professional office/general business spaces 1,549-1,971+/- square feet at 81 Bridge Street, Yarmouth, ME at the Sparhawk Mill. Situated right on the Royal River, this four-story historic building has undergone extensive renovations. Amenities include newly paved ample on-site parking, amazing views of the Royal River, easy interior & exterior egress, and direct access to US Route 1 and I-295.

Cardente Real Estate is pleased to offer for lease two premier professional office/general business spaces 1,549-1,971+/- square feet at 81 Bridge Street, Yarmouth, ME at the Sparhawk Mill. Situated right on the Royal River, this four-story historic building has undergone extensive renovations. Amenities include newly paved ample on-site parking, amazing views of the Royal River, easy interior & exterior egress, and direct access to US Route 1 and I-295.

CARDENTE REAL ESTATE FEATURED LISTINGS- AUGUST 13, 2020

Cardente Real Estate Featured Listings- July 28, 2020

Cardente Real Estate Leases 33,973 Distribution Center to Federal Express

4,035 +/- SF NOW AVAILABLE AT 40 MANSON LIBBY ROAD IN SCARBOROUGH

Cardente Real Estate Leases 2,310 +/- Square Feet of Office Space

Cardente Real Estate is pleased to announce that ALCOM has leased from Fore Street Investments, LLC, 2,310+/- square feet of office space located on the 2nd floor of 322 Fore Street in Portland, Maine. This transaction was brokered by Matthew Cardente of Cardente Real Estate.

Cardente Real Estate COVID-19 Resources & Policies

Cardente Real Estate Featured Listings- June 2, 2020

Cardente Real Estate Brokers 33,973 +/- Square Foot Lease To Federal Express in Portland, Maine

Cardente Real Estate Featured Listings - February 26, 2020

UP TO 34,230 +/- SF AVAILABLE AT PORTLAND'S PREMIER DISTRIBUTION FACILITY

CARDENTE REAL ESTATE SELLS SABLE OAKS REDEVELOPMENT SITE IN SOUTH PORTLAND

Cardente Real Estate is pleased to announce that Confluent Development, LLC, has purchased 6.27+/- acres of commercial land at 165 Running Hill Rd & 200 Country Club Rd in South Portland, Maine. Located at the entrance to the subdivision, the property was purchased for $2,603,443 on January 27, 2020 from Running Hill Real Estate Development, LLC. This transaction was brokered by Cardente Real Estate and Jeffrey Hyman of Colliers International.

Cardente Real Estate Featured Listings - February 7, 2020

To Additional Tour Dates Added for Portland Investment Portfolio To Accommodate Interest

BROCHURE FOR PREMIER INVESTMENT PORTFOLIO RELEASED

PREMIER COMMERCIAL PORTFOLIO FOR SALE IN DOWNTOWN PORTLAND, MAINE - 130,000 +/- SF OFFICE TOWER & NEWLY BUILT 256 VEHICLE PARKING GARAGE

CARDENTE REAL ESTATE LEASES 1,626 +/- SF OLD PORT RETAIL SPACE

Prime Retail Space Leases in Portland’s Old Port

Cardente Real Estate is pleased to announce that Underneath, LLC has leased of 1,626 +/ -square feet of retail space from Mainescape Properties, LLC at 92 Exchange Street in Portland, Maine. This transaction was brokered on behalf of the Landlord by Matthew Cardente of Cardente Real Estate and on behalf of the Tenant by Dave Tucci of KW Commercial.

CARDENTE REAL ESTATE SELLS LANDMARK PAYNE ELWELL PROPERTY IN YARMOUTH, MAINE

Landmark Payne Elwell House Sells in Yarmouth, Maine

Cardente Real Estate is pleased to announce that sale of the Payne Elwell House located at 162 Main Street in Yarmouth, Maine. Consisting of 3,891 +/- square feet of commercial space with onsite parking, this multi-tenanted investment property sold for $450,000 on October 2, 2019. This transaction was brokered on behalf of the Seller, One Kenwood, LLC by Matthew Cardente of Cardente Real Estate and on behalf of the Buyer, 162, LLC, by Charlie Craig of the Dunham Group.

CARDENTE REAL ESTATE WEEKLY COMMERCIAL LISTINGS UPDATE 9.28.19

3,550 +/- SF LEASED AT FOX STREET BUSINESS CENTER

CARDENTE REAL ESTATE REPRESENTS MORRISON CENTER IN PURCHASE OF 31 CENTRAL STREET IN WESTBROOK, MAINE

Cardente Real Estate is pleased to announce that The Morrison Center has purchased 31 Central Street located in Westbrook, Maine. Consisting of a 3,300 +/- square foot office building, the property was bought from Double Agents, LLC for $570,000 on September 20, 2019. This transaction was brokered on behalf of the Buyer by Greg Perry of Cardente Real Estate and on behalf of the Seller by Justin Lamontagne of NAI Dunham Group.

Cardente Real Estate Weekly Listings Update

JOE DIONNE JOINS THE CARDENTE REAL ESTATE BROKERAGE TEAM

CARDENTE REAL ESTATE LEASES 4,000 +/- SF RETAIL UNIT AT 301 FOREST AVENUE

Bayside Psychology Leases Office Space at Lower Falls Landing in Yarmouth

5TH ANNUAL MCAR CHARITY GOLF TOURNAMENT Benefiting the Morrison Center - Sign Up Now!

5TH ANNUAL MCAR CHARITY GOLF TOURNAMENT

Benefiting the Morrison Center - Sign Up Now!

WHEN: Tuesday, September 17, 2019

WHERE: Prouts Neck Country Club

TO REGISTER A TEAM: Please go to the below link:

https://files.constantcontact.com/…/a289e169-1432-4b2d-80bd…

SPONSORSHIP OPPORTUNITIES: Please go to the below link:

https://files.constantcontact.com/…/ced42e76-a4f4-4c61-af40…

FOR ADDITIONAL INFO / QUESTIONS:

Contact:

Greg Perry | Senior Partner/Broker

Cardente Real Estate

Direct Line: 207-558-6116 | Cell: 207-838-8146

Email: greg@cardente.com

CARDENTE REAL ESTATE SELLS 221 UNIT SELF STORAGE FACILITY IN PORTLAND

CARDENTE REAL ESTATE SELLS 24,510 +/- SF RETAIL CENTER IN PORTLAND

Cardente Real Estate is pleased to announce that All-American family, LLC purchased the 24,150 +/- square foot retail center located at 1041 Brighton Avenue in Portland, Maine from 1041 Brighton Ave., LLC for $2,991,443 on July 16, 2019. This transaction was brokered on behalf of the Purchaser by Greg Perry of Cardente Real Estate and on behalf of the Seller by Charles Day of Porta & Co.

Now Offering For Sale By Auction - 477 Congress Street, Portland, Maine

We are pleased to offer for sale by auction the Time & Temperature Building located at 477 Congress Street in Portland, Maine.

Upcoming Pre-Auction Showing Dates

Thursday, September 6th - 12 PM - 3 PM

Friday, September 7th - 9:30 AM - 11:30 AM

Wednesday, September 12th - 12 PM - 3 PM

Thursday, September 13th - 9:30 AM - 11:30 AM

Please contact us if you plan to attend so we can put you in the calendar for the time and date of your choice. More showing dates for later in September to be announced. As a reminder, the real estate auction starts on October 9th, 2018. For additional information regarding the auction and registration, please see below.

Apartment Project Envisioned as Bayside Centerpiece Appears Dead

continued on pdf:

continued on pdf:Former Siano's Pizzeria Sells

Cardente Real Estate Brokers $1.1M Sale of Restaurant Property in Portland, Maine

Cardente Real Estate has arranged the sale of a restaurant property located at 476 Stevens Ave. in Portland. Rock Properties sold the property to 476 Stevens Ave LLC for $1.1 million. Siano’s Pizzeria formerly occupied the 4,091-square-foot restaurant building. Cheri Bonawitz of Cardente Real Estate represented the seller, while Mike Anderson of Malone Commercial Brokers represented the buyer in the deal.

Historic Downtown Bangor Building Sells for $1.9 Million

A historic building on Bangor's Main Street was sold for nearly $1.9 million last week to a Colorado developer.

A historic building on Bangor's Main Street was sold for nearly $1.9 million last week to a Colorado developer.

Cardente Accepted to Forbes Council

Matthew Cardente of Cardente Real Estate Accepted into Forbes Real Estate Council

Portland, Maine – December 7, 2017 - Matthew Cardente has been accepted into the Forbes Real Estate Council, an invitation-only community for executives in the real estate industry. Mr. Cardente joins other Forbes Real Estate Council members, who are hand-selected, to become part of a curated network of successful peers and get access to a variety of exclusive benefits and resources, including the opportunity to submit thought leadership articles and short tips on industry-related topics for publishing on Forbes.com.

In 2005, Matthew founded Cardente Real Estate in Portland, Maine. Over a decade later, Cardente Real Estate has grown into a leading commercial real estate brokerage in Northern New England.

Forbes Councils combines an innovative, high-touch approach to community management perfected by the team behind Young Entrepreneur Council (YEC) with the extensive resources and global reach of Forbes.

“I look forward to collaborating with other Real Estate Council Members and Forbes.com.” Says Matthew Cardente, “Being accepted into the Forbes Real Estate Council sets a new milestone for my real estate career.”

Scott Gerber, founder of Forbes Councils, says, “We are honored to welcome Mr. Cardente into the community. Our mission with Forbes Councils is to curate successful professionals from every industry, creating a vetted, social capital-driven network that helps every member make an even greater impact on the business world.”

About Forbes Councils

Forbes partnered with the founders of Young Entrepreneur Council (YEC) to launch Forbes Councils, invitation-only communities for world-class business professionals in a variety of industries. Members, who are hand-selected by each Council’s community team, receive personalized introductions to each other based on their specific needs and gain access to a wide range of business benefits and services, including best-in-class concierge teams, personalized connections, peer-to-peer learning, a business services marketplace, and the opportunity to share thought leadership content on Forbes.com.

For more information about Forbes Real Estate Council, visit https://forbesrealestatecouncil.com. To learn more about Forbes Councils, visit www.forbescouncils.com.

3rd Annual MCAR Golf Tournament Raises $12,000 for The Morrison Center

Greg Perry, tournament organizer, is proud to announce that more than $12,000 was raised to benefit The Morrison Center at the 3rd Annual MCAR Charity Golf Tournament on September 19 at Prouts Neck Country Club. The Morrison Center provides comprehensive programming, individualized supports, and employment services for people of all ages with disabilities. This year's Cardente Real Estate team included (pictured left to right):

Mark Sandler, Cheri Bonawitz, Michael Cobb and Kirk Mullen (of The Rowley Agency).

A huge THANK YOU to all players, sponsors and volunteers!

Growth spurs The Morrison Center's expansion in Wells

Growth spurs The Morrison Center's expansion in Wells

WELLS — Demand for the services of The Morrison Center, a nonprofit whose mission is to help people of all ages with disabilities, has prompted the expansion of its facilities in Wells.

The Morrison Center purchased an office building at 2250 Post Road for $300,000 to facilitate its expansion. John Downing of The Downing Agency represented seller Douglas Merrill and Greg Perry of Cardente Real Estate represented The Morrison Center in a deal that closed Jan. 4.

"The community is wonderful," said Executive Director Mark Ryder. "We love being part of Wells."

The Morrison Center incorporated in the 1950s in Portland. The organization today operates three campuses — its headquarters in Scarborough, a smaller facility in Portland and its first facility in Wells, at 526 Post Road.

Rapid growth

Specializing in complex and involved developmental disabilities, the center's programming includes a preschool and childcare program, a K-12 special-purpose grade school, adult day community support programs, case management services for children and adults, and an integrated therapy clinic for all ages. Its support team includes educators, therapists, direct care professionals, and a full-time registered nurse. New this year, the center partnered with the Maine Educational Center for the Deaf and Hard of Hearing on Falmouth's Mackworth Island to help advance educational services for the K-12 program there. Morrison also is in its second year of partnering with School Administrative District 55 to provide specialized preschooler services within South Hiram Elementary School.

Client numbers overall have tripled in the past five years, Ryder said. On the children's side, the organization had six K-12 students overall five years ago; today it serves over 30.

The adult side doubled in the past five years. Case management, a new program as of five years ago, now serves over 100 individuals. The organization also runs nine residential group homes, and there's a waiting list.

Increased clientele, said Ryder, reflects both increased need and the "build it and they will come" scenario — families with members previously in need simply didn't have a place to go for highly specialized services.

Four years ago, the organization decided to establish a facility in Wells and bought the 526 Post Road property — the former Mainiax restaurant — gutted it and reproduced a facility similar to Scarborough's, but on a smaller scale, for adult, pre-school and K-12 programs. That program filled up within a year.

Ryder and his board of directors decided to search for a second facility in Wells, a community that's proved supportive of the organization. The goal was to find a nearby property to relocate the adult program, thus also allowing the children's program to expand in the existing facility.

What the new expansion accomplishes

"That's where the 2550 Post Road building comes into play," Ryder said.

The 2,300-square-foot building, formerly a chiropractor's office, is just down the street from the existing facility.

The agency expects to invest about $200,000 in refitting the space. The exterior will remain the same. The interior will be gutted and reconfigured with small treatment rooms, a large activity space with a culinary corner (clients love to cook and it develops independent life skills), a therapy room with specialized equipment, and personal care space with mobility equipment used to support clients.

Work was expected to start mid-January. The goal is to be operational by March 15.

The staff will also grow, he said.

The agency currently employs about 250; about 20 of them are in Wells. The Wells expansion will result in more hiring, probably an initial six to 10, depending on how quickly space is filled.

For the future, said Ryder, "We hope to expand the Wells program even more — creating a state-of-the art school building as well as developing additional adult programming facilities. This is our first step in our Wells strategic expansion plan."

What makes the property perfect, Ryder said, is its location in the heart of town.

"Our folks can be in close proximity to what's happening, so we can integrate them into the community," he said.

The current Wells space serves approximately 20 adult clients and about 30 preschoolers. The new space will be able to serve between 40 and 50 adults. Capacity for preschoolers at the older Wells facility will become 55-60.

Mix of financing

As a 501c3 nonprofit, the purchase and rebuild are financed through existing capital funds, new lending, donations, and fundraising.

Two fundraisers were spearheaded by Morrison Center broker Perry. In fact, that's how Perry ended up working with the agency to find a property. Perry is on the board of directors of the Maine Commercial Association of Realtors, which does at least two volunteer events per year. In 2015, the MCAR board selected Morrison as a beneficiary. Perry, with the board's help, organized a golf tournament at Prout's Neck Golf Course as the fundraiser, which raised about $8,000. MCAR's second golf tournament fundraiser last fall for Morrison raised about $11,000.

"It's a really good place to contribute to," said Perry.

The Maine Commercial Association of Realtors board recently voted to stick with Morrison for its next event.

"We feel so fortunate to have their support," said Ryder.

Broad Street luxury apartment building fetches $3.12 million in sale

BANGOR, Maine — A longtime Broad Street sporting goods store converted into luxury apartments has been sold to an out-of-state developer for $3.12 million.

The 18 luxury units at 28 Broad St. were sold by 28 Broad St. LLC to another limited liability corporation, New Hampshire-based Broad Street LLC, on Jan. 13, said Michael Cobb, a broker at Cardente Real Estate of Portland.

Friday’s closing capped 6½ months of negotiations, Cobb said Wednesday.

“It is an out-of-state investor who was interested. He liked the tenant mix and income ratios coming in from that. That’s where the number [sale price] comes from,” Cobb said. “On this type of property, in Bangor, I haven’t seen any other properties sell for this kind of price point.”

Former building owner Roy Hubbard said he and his partners were tempted to hang onto the building but the sale made sense.

“We certainly got a healthy per-unit price, which we are very happy about,” Hubbard said Wednesday. “I have mixed feelings about selling, but at the end of the day, I am not a landlord. I am a developer. My job is to bring something back to life. Then I find something else to bring back to life.”

The 27-year-old, who splits time between Connecticut and Maine, invested about $2 million and two years in renovations on the former Dakin Sporting Goods building. Hubbard bought the building for about $650,000. He opened three ground-floor apartments to public viewing in March 2016 during the Downtown Bangor Artwalk.

The building is currently fully occupied, and there is a tenant waiting list, according to Cardente Real Estate.

The site had been largely vacant since the late 1990s, when it briefly housed a coffee shop, cafe and TCBY yogurt shop. It also served as temporary headquarters for political campaigns.

Tanya Emery, the city’s director of community and economic development, said the sale price seemed about right.

“We knew it was for sale and it seems like a solid price for an exceptionally renovated building with strong occupancy numbers,” Emery said Wednesday.

Bangor is changing to accommodate people gravitating toward urban centers and a growing entertainment corridor, but still needs affordable rentals, officials said.

Hubbard is interested in continuing to rehabilitate buildings in Bangor, if he finds the right deal. Bangor’s market is growing, he said.

“It is scarce to find unused square footage downtown. When I got started, downtown the vacancy rates were incredible. It’s just not the case now,” Hubbard said. “I would be more inclined to do lower-rent apartments. I think with the higher-rent per-square-foot apartments, it’s hard to find space for that which could work. I think there is still a demand for that, but you need to get more people in there. It is easier for more developers to go lower-scale, to something more moderate.”

“I like Bangor,” Hubbard added. “It’s too expensive in Portland. Bangor is the only place I am really comfortable investing in. It is quieter and a lot more personal to me.”

Bangor Daily News writers Nick McCrea and Darren Fishell contributed to this report.

MEREDA conference highlights 'worker gap'

MEREDA conference highlights 'worker gap'

The Maine Real Estate and Development Association's bi-annual economic indicator measuring the health of Maine's real estate sector, The MEREDA Index, shows a significant "worker gap" that is driving up the cost and increasing the timeline of construction projects, according to a release about the index.

Unveiled at Thursday's sold-out annual MEREDA forecast conference, the index showed strong growth in the residential construction sector.

"Overall, The MEREDA Index has grown in the last years, though we are seeing the first plateau since the post-2007 recovery," Paul Peck, MEREDA president, a real estate developer and an attorney at Drummond & Drummond, said in a statement. "The second quarter of 2016 saw us reach the highest level in 10 years, led by a 10% growth in the residential component."

All told, The MEREDA Index, which covers the middle two quarters of 2016, came in at 93.

The second quarter of 2016 saw The MEREDA Index reach its highest level since 2006, led by a 10% growth in the residential component. But the second quarter's gains were not sustained into the third quarter, and at the end of the third quarter the index was just below its highest level since 2006.

The third quarter drop occurred primarily in the residential sector but also in the commercial sector. Over the past six months, the index grew 1.2% and over the year by 0.9%. Overall, the index indicates that recovery from the real estate recession continued, but slowed over the past year.

"The gains of the second quarter of 2016 were not sustained into the third quarter, with a 4% drop relative the second quarter," said economist Charles Colgan of the University of Southern Maine, who compiled the report for MEREDA.

Tackling the 'worker gap'

The lack of qualified candidates available to fill electrician, plumbing and other subcontractor positions that might be driving up the cost and increasing the timeline of construction has spurred MEREDA to launch a subcommittee with the Associated General Contractors of Maine to address the worker gap.

"The worker gap issue must be address if Maine is to benefit from continued economic investment, an expanded tax base in our neighborhoods and communities and a robust tourism economy," Peck said.

MEREDA's annual forecast conference featured more than half a dozen forecasts of future market activity by property type and geography, from top experts in the following categories: Maine's vacation and hospitality industry; southern Maine industrial, office, retail and residential; plus specific forecasts for the midcoast, Bangor area and central Maine markets respectively.

The new edition of The MEREDA Index was underwritten by Eaton Peabody, with support from CBRE | The Boulos Company, Wright-Ryan Construction and The Press Hotel.

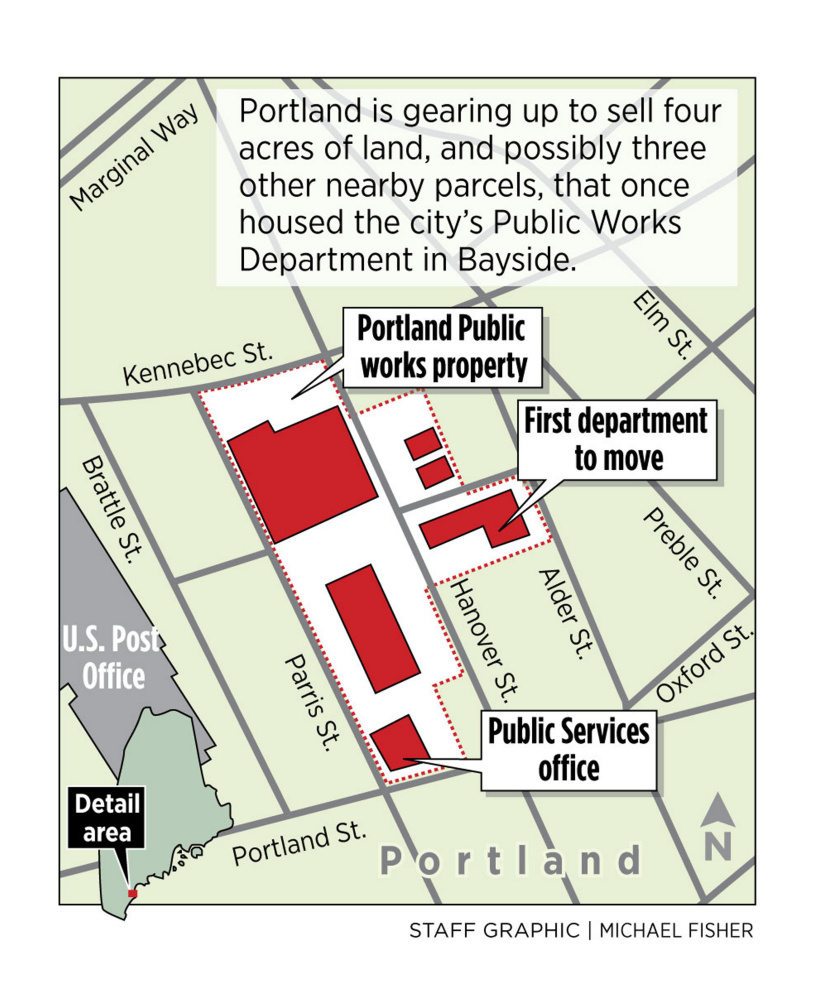

City of Portland prepares to put prime Bayside land on the market

Four acres of land with significant development potential near Portland’s downtown could be available for sale by the end of the year, according to the city’s economic development director.

Greg Mitchell said city officials will likely choose a real estate broker in the coming weeks for land used by the city’s Public Works Department in Bayside, launching a process that could alter the course of one of Portland’s long-struggling neighborhoods. The only restrictions placed on the sale would be the current zoning, Mitchell said, and the city is open to selling all of the land to one buyer, or selling it by the parcel.

Given the property’s location and zoning, which permits a wide range of uses, Mitchell expects that some sort of mixed-use development – including residential, office, retail and possibly a fitness center – could replace the current industrial-scale uses.

“I think this is an opportunity of a lifetime,” Mitchell said. “I think it would have a dramatic impact on spurring more investment in that area. Four acres is quite a piece of real estate in a downtown area. The redevelopment of that area could have a dramatic impact on setting a direction in an area.”

Moving Public Works out of Bayside has been a goal of the city since the 1990s. After toying with potentially moving the department out to Riverside Street, among other options, the city in 2013 began securing a 13-acre site at 212 and 250 Canco Road, an industrial area in the geographic center of the city.

Over the last year, the city focused more attention on the Bayside neighborhood, which is home to a multitude of social service groups, including the homeless shelters and soup kitchens. Last summer, the city directed more police attention to the area to deal with unruly behavior and made more of an effort to pick up litter, sweep the streets and rebuild sidewalks. It also has begun to rethink the way the city provides emergency food and shelter.

Given that the “midtown” project, including more than 400 apartments, has stalled and is possibly being revised again, residents in Bayside hope that the city’s effort to sell and redevelop the public works properties will go more smoothly, said Bayside Neighborhood Association President Steve Hirshon. He noted that after five years of planning for the midtown development, no shovel has hit the ground.

Hirshon suggested that residents are cautiously optimistic about the future.

“We understand there’s a lot of potential for development in the neighborhood, and obviously that’s exciting, but there’s the issue of: How do you maintain a neighborhood that managed to survive the fire of 1866?” Hirshon said, referring to the fire that destroyed a third of the city’s downtown area. “I think we’d like to maintain a semblance of what we have, and at the same time, welcome whatever new comes along.”

The estimated cost for relocating the Public Works Department is $15.5 million, with about $8.4 million already appropriated. On Monday, the City Council allocated $1 million from the recent sale of 3½ acres of land on Somerset Street to Federated Cos. for the midtown project toward upgrading facilities at Canco Road, leaving about $7 million in remaining costs.

Mitchell said most of the public works operations, except for its fleet services at 44 Hanover St., have been moved to Canco Road. Administrative offices at 55 Portland St. will remain for now, but that building may be put on the market at a later date.

Moving fleet services would require a new building at Canco Road, so that would not occur until funding is secured, either through a bond or using revenue from the sale of the land, or a combination.

The city expects to open bids from potential real estate brokers Tuesday, Mitchell said. “I would expect we would make decisions quickly in hiring a broker,” he said.

The city is looking to immediately list four properties and may list an additional three properties, all of which are scattered throughout the area generally bordered by Portland, Alder and Kennebec streets and Forest Avenue, according to a request for proposals for commercial real state brokers. The properties to be listed are 56 Parris St.; 82 Hanover St.-158 Kennebec St.; 65 Hanover St.-52 Alder St.; and 44 Hanover St.

The properties are split between two business zones, which in some cases allow for 105-foot-tall buildings. Two parcels – a nearly 1.3-acre site at 82 Hanover St. and a nearly 1-acre site at 44 Hanover St. – could potentially be combined, according to the RFP, which also contemplates extending Somerset Street to Hanover Street and realigning Kennebec Street to Forest Avenue. Other properties, namely 55 Portland St., 178 Kennebec St., and 181 Forest Ave., may also be put up for sale.

Mitchell said he suspects that existing brick buildings could be renovated and incorporated into any new development plan, while open lots and a metal shed at 44 Hanover St., which houses fleet services, could be remade from scratch.

Mitchell declined to say how much he believed the city could get for the property, other than to say it could be a “significant” amount.

He said the real estate market is strong, the property is close to downtown, and there is already development going on in Bayside, including the new Chipotle and Bangor Savings Bank locations on Marginal Way, the expansion of Bayside Bowl on Alder Street and the conversion of the Schlotterbeck & Foss building on Portland Street into market-rate housing consisting of a mix of 56 studio and one-bedroom apartments.

“I feel there is a very high level of interest,” Mitchell said. “We’re continuing to see development in Bayside and we’re in the center of that.”

Three solid quarters in 2016 and counting for southern Maine's commercial real estate market

Heading into the 4th quarter of 2016, the commercial real estate market in Southern Maine remains strong with no immediate signs of a slowdown. Several key indications of the ongoing market strength include low / declining vacancy rates, high buyer demand, and limited supply of investment grade properties.

Office

Year to date, the leasing market for higher end office has performed well for landlords in Portland and the surrounding municipalities. One prime example is Ocean Gate Plaza located at 511 Congress St. in Port- land. Approximately 100,000 s/f of this 130,000 s/f complex consists of nine stories of class A office space that is currently 100% leased. At the time the property was purchased in March of 2014, the office vacancy rate for the office tower was closer to 9%. CBRE, The Boulos Co. produces an annual office market survey based on approximately 12 million s/f of class A and B office in Greater Portland. “The overall office vacancy in Greater Portland continues to trend downward and is likely in the 5% range heading into the 4th quarter”, said Drew Sigfridson, managing director & partner of CBRE the Boulos Company, “ We have witnessed a flight to quality over the past year with class A office vacancy rates likely below 4% for both suburban and downtown buildings. However, class B and lower quality product continue to experience prolonged vacancies.”

Retail

Southern Maine’s retail market is flourishing as well. In March, the 13-acre Falmouth Plaza was pur- chased by developer Matthew Orne for $11.55 million on Feb. 2, 2016. Located approximately 10 minutes from downtown Portland, the purchase chase of retail complex included a 92,000 s/f Wal-Mart and the adjacent vacant Regal Cinema. Later this year, Flagship Cinemas leased the former cinema and is now open for business after the 15,000 s/f unit was vacant for four years. Steve Baumann of Compass Commercial Brokers handled the sale and cinema lease for the new owner. Other positive signs for the market is the lack of inventory for lease in the major retail districts of Greater Portland. According to the New England Commercial Property Exchange database, as of mid-October 2016, there were a total of 40 retail listings for 1,000 – 3,000 s/f in Port- land and South Portland combined. These cities includes Portland’s Old Port and the Maine Mall district. The same database indicated that there were a combined total of thirteen retail units ranging from 5,000 – 10,000 s/f and four 15,000 – 200,0000 s/f retail boxes available in total for Portland and South Portland.

Industrial

Greater Portland’s industrial mar- ket is seeing increased price points, low inventory, and tenant/buyer com- petition. In part, this is due to high de- mand from marijuana cultivators and breweries that have been expanding into the marketplace. “Over the last six years, industrial lease rates and sales prices have consistently trended and vacancy rates have dropped,” said Justin Lamontagne, partner at The Dunham Group out of Portland. “We anticipate a 3-4% vacancy rate for Greater Portland industrial space by year end 2016.”

Investment & Owner Occupant Sales

Southern Maine’s commercial sales for investment and owner occupant properties is arguable the hottest market. Owner occupants continue to take advantage of the historically low vacancy rates. Formerly tenants, these new owner occupants are often paying less on their mortgage than they were on their former lease rate. For Maine investors, the continuation of low interest rates combined with the state’s attractive capitalization rates has made investment properties scarce within the region. Capitalization rates for higher end office, retail, and industrial properties are currently trending between 8-9.5% in the prominent marketplace; 7-8% for premium multi-units and properties offering long-term leases from high credit tenants. Investments sales in secondary markets and higher risk properties are offering capitalization rates 9.5% to above 10%. These types of capitalization rates are not as prevalent in other states in New England making Maine a prime target for local and national investors.

Green Clean moves from leased space to new $425K Portland HQ

PORTLAND — A gung-ho cleaning service, Green Clean Maine, has been skyrocketing since its founding in 2007.

That's why founder and CEO Joe Walsh decided to buy larger quarters to house the business.

Walsh purchased the 4,768-square-foot, three-level office building at 583 Warren Ave. in Portland, just west of the Maine Turnpike/I-95 overpass, from Casey & Paige LLC for $425,000. The deal closed Sept. 16.

Amenities include 25 onsite parking spaces plus a two-bay garage and deck. Walsh was represented by Matthew Cardente and Mark Sandler of Cardente Real Estate. Mark Malone of Malone Commercial Real Estate represented the seller.

"Joe and I had been searching for properties over the past year," said Sandler. "This property fit perfectly into our mix of an owner/user investment property. Joe has the option to use a portion of the property to grow other aspects of his business or lease it out for extra income."

Reached by phone after attending the Goldman Sachs "10,000 Small Businesses" program in Boston, Walsh said the new space is about six times larger than the current leased space.

"We're moving out of an 800-square-foot space. It's tiny," he said. "I can't even believe we've been there that long."

The new building and grounds will allow for continued growth. That includes space for equipment for the field staff, supplies like low-moisture mop systems, high-performance commercial backpack vacuums, all-natural handmade cleaning formulas, cleaning trays, microfiber cloths, cotton cloths for glass, terrycloth mops for floors and microfiber dusters to get up high and down low.

There's now also more space for the growing administrative and customer service office staff and a laundry plant with washers and dryers. The crew launders 1,500 to 2,000 cleaning cloths per day, a production line where the company produces cleaning supplies and will eventually package them for consumer sales. Outside is a fleet of environmentally friendly electric hybrid or fuel-efficient vehicles.

The building is about 40 years old and in good shape, requiring minimal renovations such as paint and carpeting.

"It was already laid out in a way that, when I walked in I knew it would be great for us," said Walsh.

The move was planned for Oct 22-23.

Non-toxic cleaners can't keep up with demand

Walsh's entrée into cleaning services was a surprising turn from his previous career as an advertising salesman for the Sunrise Guide, a Westbrook-based publication about healthy and sustainable resources. He was approaching environmentally friendly residential cleaning services about advertising.

"Everyone I talked with who was doing it in a nontoxic way said they couldn't advertise because they already couldn't keep up with demand," he recalled.

The popularity of the service and the promise of good money meshed with his personal predilection for a clean and tidy home. He received a $5,000 grant from the Libra Future Fund and got his first client, a friend with a condo, in October 2007. He hired his first employee in January 2008. Now he has 30 employees and, he said, the company is the largest residential cleaning service in Maine, with about 400 subscribers, from Saco to Freeport, who register for an average of 3.5 to 4 years, with the average client signing up for bi-weekly service.

Recently, he was a finalist in the Maine Center for Entrepreneurial Development's "Top Gun" program, developing a vision for the company's future. Plans include additional services such as helping homeowners with other aspects of their lives, such as dog-walking, carpet-washing and concierge services.

Walsh plans to expand the commercial cleaning side. And he plans to increase production of natural cleaning supplies, which use baking soda, vinegar, essential oils and other plant-based ingredients. Customers often ask to buy his supplies, so he's developed product labels and is finalizing packaging for sales.

"This building will make room to add divisions and service lines as we grow," he said.

Also, the property is over two acres, so there's enough land and buffer to add at least another 5,000 square feet of space.

"That's part of the property's appeal as well," he said.

So why does he like to clean?

"I'm a little bit of a perfectionist," he said. "It's the satisfaction you get from making something just right, starting off with something dirty or chaotic and making it clean and neat. But what I didn't like was the chemical part. I was interested in creating an environmental benefit and making money at the same time."

Editor's note: Green Clean Maine cleans the Mainebiz offices.

UMaine trustees launch initiative to create $150M graduate center

UMaine trustees launch initiative to create $150M graduate center

The University of Maine System's trustees in a special meeting on Sunday unanimously approved the first phase of a $15 million fund-raising effort for an ambitious $150 million plan to create a new graduate center for business, law and public policy in Portland.

The resolution approved by the trustees doesn't fully commit the University of Maine System to the $150 million capital investment that would be required to fulfill the business plan for the proposed Maine Center, which calls for a new $93.6 million building and a $45 million endowment. At this point, it simply authorizes UMaine Chancellor James Page to seek additional funding from private foundations and other funding sources, including the Harold Alfond Foundation, which contributed more than $2 million to the planning process that led to the development of the business plan.

"The Maine Center plan is aspirational, exemplifying our 'One University' commitment to move our state forward with innovative programing and stronger engagement with Maine's business, legal and community leaders," Page said in a statement announcing the initiative.

Maine Center CEO Eliot Cutler, an unsuccessful Independent candidate in Maine's 2010 and 2014 gubernatorial races and a founding partner of the environmental law firm Cutler & Stanfield LLP, led the 18-month assessment of UMaine's graduate programs that culminated in the graduate center's business plan. That effort included the establishment of a 100-member advisory board, discussions with faculty and more than 400 meetings in town halls, board rooms, law offices, judicial buildings and college campuses.

"The willingness of so many people inside and outside the university to engage with us shows how necessary everyone recognizes these changes and reforms are for the rebirth and growth of Maine's economy," Cutler said in a statement. "By breaking down the walls and silos in graduate programs that already are vanishing from the real world of work, the Maine Center will breed the kinds of collaborative, relationship-building, analytic and communications skills that are increasingly valued by Maine and national employers."

Why now?

The proposed Maine Center will bring under one roof in Portland the UMaine system's single, merged MBA program, the Maine Law School and the Muskie School of Public Service with its graduate programs in public health and public policy and management. It also calls for a conference center and an incubator/accelerator and would house the Cutler Institute for Health and Social Policy.

The business plan explicitly states that the initiative is in response to the needs of Maine businesses for workers with higher-level skills: "Increasing numbers of jobs in the new economy require a higher level of educational attainment, and the levels of bachelor, graduate and professional degree attainment in Maine are substantially below the national median."

"In this time of global connectivity and competition the professional education provided by our public universities must be irrevocably linked to the firms, businesses and organizations that are creating opportunity across our state and building our economy," Sam Collins, chairman of the UMaine System board of trustees, said in a statement.

The business plan also seeks to turn around recent trends of declining enrollments among all the graduate programs in the UMaine System, in part due to increased in-state competition: "The growth rates for MBA degrees conferred by Husson University, Thomas College and the UMaine System institutions for the period 2002 to 2014 illustrate a considerable loss of market share for the University of Maine and University of Southern Maine," the business plan states.

Next steps

Stage 1 of the plan will begin in January 2017 and will carry a timeline of two to three years to meet fund-raising milestones. It also calls for the UMaine and USM MBA programs to be integrated by the fall of 2017; the establishment of the Maine Center Ventures; and development of new programs designed to meet the business plan's objectives. The UMaine universities will also continue to support the business, public policy and legal professional graduate programs at current funding levels of approximately $3.2 million annually.

Once Stage 1 benchmarks have been met, Stage 2 envisions consulting with foundation partners, Maine's professional community, the universities and the UMaine board to make sure the financial support and essential programs are in place to proceed with building a new $93.6 million Maine Center facility in Portland.

If all goes according to the business plan's timetable, the Maine Center building would open in 2021. It is expected to achieve a 600-student enrollment in its graduate programs by 2024.

"The center will host a score of executive education and certificate programs and will be financially self-supporting," the business plan states. "By the middle of the following decade [i.e. 2035], the $150 million capital investment in the center will be returning billions of dollars in direct and indirect benefits to Maine communities."

MRRA welcomes public to picnic

BRUNSWICK

The Midcoast Regional Redevelopment Authority held its annual open house and picnic Wednesday night, providing the public a chance to talk with MRRA officials and get to know a little more about the base redevelopment.

The event drew members of the public and tenants as well as town officials, offering them a chance to speak with MRRA Executive Director Steve Levesque and take a guided tour via Maine Bus Rentals.

The event was catered by New Beet Market, with owner Nate Wildes touting the many Maine-made and in-house creations.

Maine-made red hot dogs, Maine-grown corn on the cob, black bean burgers and pulled pork sandwiches with Maine-grown pork were served along with an array of salad sides. Even the buns used were locally baked, according to Wildes.

“The exciting thing about (Brunswick) Landing is everybody’s growing together,” Wildes said. “The Landing is doing a good job of working together and grow.”

MRRA Executive Director Steve Levesque talks with Town Council Chairwoman Sarah Brayman at the annual MRRA open house and picnic. DOUGLAS MCINTIRE / THE TIMES RECORD Wildes said Brunswick Landing has become a very “complementary community” where everyone is working in each other’s best interest by branding and marketing the area as “a cool place to come.”

MRRA Executive Director Steve Levesque talks with Town Council Chairwoman Sarah Brayman at the annual MRRA open house and picnic. DOUGLAS MCINTIRE / THE TIMES RECORD Wildes said Brunswick Landing has become a very “complementary community” where everyone is working in each other’s best interest by branding and marketing the area as “a cool place to come.”

“Every day we get people in the restaurant who say, ‘I haven’t been out here since it was an active Navy base — I can’t believe how much has changed,’” Wildes said.

Douglas Cardente is one of the developers at Brunswick Landing. He purchased the American Bureau of Shipping building on Leavitt Drive. The property was once part of the Navy Survival Evasion Resistance and Escape school program.

“It’s a new building and I think one of the best ones out here,” Cardente said.

Besides ABS, Cardente said Harpswell Coastal Academy is moving in from its former location in the same building as Seeds of Independence. Cardente said that since the building was formerly used for educational purposes, it’s a natural fit for HCA.

Cardente said that with his purchase, there came an additional 12 acres that he may develop down the road into office buildings.

“(Levesque) has been a great promoter of this area and even tonight, he just wants to make sure that every base is covered in terms of letting everyone know what’s here and what’s available,” Cardente said.

Levesque said the event has drawn in mostly members of the community, curious about MRRA and how the former base is being developed.

“It’s really just to open the place up to the community and let them know what’s going on — a lot of people don’t know,” Levesque said.

To get word out, Levesque said they sent out mass mailings and put notices in the newspapers.

Levesque said it gives MRRA a chance to dispel misinformation that people might hear. One story Levesque tries to set straight is the misconception that the town isn’t receiving property taxes from the former base. The home page of the MRRA website notes more than $2.5 million in taxes paid to the town.

Brunswick Downtown Association Director Deb King was also present at the event. King said that besides MRRA, there are many businesses at Brunswick Landing who are part of the association.

“We are really excited about the growth out here,” King said.

King said the BDA has a definite interest outside of the immediate downtown area and will continue reaching out to tenants as they arrive, such as Wayfair.

“I’m absolutely thrilled with the efforts of MRRA and the accomplishments — as everyone knows, they’ve far surpassed the expectations at an award winning pace,” King said — something that bodes well for the entire community.

Duffy's makes long-term commitment to Old Orchard Beach

OLD ORCHARD BEACH — Duffy's Tavern and Grill of Kennebunk paid $1.7 million for a site it had been leasing in Old Orchard Beach.

The deal gives Duffy's a second location and visibility on a road that is populated by numerous campgrounds and is also the road most visitors use as they exit Interstate 295 to go into Old Orchard Beach. Duffy's offers American comfort food and pub fare.

Located at 168 Saco Ave., the 5.2-acre property also includes a 1,904-square-foot, two-unit apartment building and a 2,552-square-foot, single-family home. The transaction, which closed July 20, was brokered by Mark Sandler of Cardente Real Estate, who represented the sellers, brothers Michael and Gregory Mezoian.

David "Duffy" Cluff, representing himself, paid $1.7 million for the property.

The Duffy's in Old Orchard Beach had operated under a lease arrangement since June 15, 2015. Cluff signed a purchase and sale agreement with the Mezoians in May 2015, then worked on nailing down a financing package.

"We did a lease with the owner so we could get it up and running while we were waiting for the financing package, working with our local bank and the Small Business Administration," Cluff said, speaking by phone.

He invested $200,000 in a complete modernization of the dining room, including adding a new bar.

"The restaurant was dated," he said. "It needed to be brought up-to-date with a little TLC."

Prior to Duffy's taking over a year ago, it was the Captain's Galley Restaurant.

The Old Orchard Beach site was attractive, he said, because of its high-traffic location and the fact that the second location — a restaurant and connected banquet center totaling 11,749 square feet — is larger than the original Duffy's and better suited to larger events. The function space in Duffy's Kennebunk seats 50; Duffy's in Old Orchard Beach seats up to 200.

"We're doing weddings, bridal showers, anniversary parties — and that's what I was looking for," he said.

He plans to rent out the two-unit apartment building and house.

Cluff came into the restaurant business as a second career. He was with the Kennebunk Fire Department for 25 years, retiring as assistant fire chief. He enjoys cooking, so in 2008, he and a partner, Shawn Spencer, started Duffy's in the Lafayette Center on Main Street in Kennebunk.

"Then I decided to open a second restaurant. And that's enough restaurants," he laughed.

In actuality, there's not much in the way of retirement in this second career. He cooks five or six nights per week, and both restaurants are year-round. Plus there's been the work of getting the second restaurant going.

"I often think back to my fire department days and think, 'Well, I thought I was busy then, but I'm really busy now,'" he said.

The OOB property was originally a motor lodge with cottages, said Sandler. The Mezoian brothers' grandfather bought in 1954, and the family built the cabins and motor lodge. The brothers started a small restaurant, the Captain's Galley, in 1987, and kept enlarging it. In 1995, they dismantled the cabins and filled in the pool.

Sandler, the broker, knew the Mezoian brothers from when he owned and operated a food distribution company, Biddeford-based Sandler Brothers. Three years ago, he got out of the business and went into commercial real estate. In January 2015, when the Mezoians decided to close the restaurant in order to focus on residential development, they turned to Sandler to market the property.

Former Owners of Paul's Food Center take on Yarmouth Retail Center

YARMOUTH — In 1975, Paul and Annamarie Trusiani purchased 585 Congress St., a mixed-use building in downtown Portland where they owned Paul's Food Center.

With the passing of Paul last September, the Trusiani family made a difficult decision to sell the property.

Enter Michael Cardente of Cardente Real Estate, who found a buyer for 585 Congress St., and then found for Annemarie Trusiani, now in her 80s and known as Momma T, a 1031 exchange property — a 13,800-square-foot retail strip center at 374 U.S. Route 1 in Yarmouth — for $1.9 million, in a deal that closed June 15. The latter property will allow Trusiani to defer capital gains taxes otherwise due on the Congress Street property — and, it's conveniently near her home.

"Mike did an amazing job in creating this opportunity for my mother," said Trusiani's son, Paul "Buzzy" Trusiani. "It was in everyone's interest to sell the Congress Street property. The way Mike was able to do that and then follow up and find another property for my mother was great."

The Yarmouth property was not on the market, said Cardente. But the seller, Fogg Farm LLC, decided to take advantage of the market's low capitalization rate and move on, Cardente said.

The strip center includes two buildings and dates to 1979. The property was perfect for Trusiani for a number of reasons, the broker said. She lives nearby and was looking for a stable investment. The center is located at the southern gateway to Yarmouth with convenient access to Interstate 295. It's extremely well-maintained and has excellent signage and visibility, and plenty of on-site parking, Cardente said.

Buzzy Trusiani agrees the purchase works well for his mother: It's low-maintenance with existing tenants and will provide a diversified base of income.

"We have a wonderful Chinese food restaurant that we greatly enjoy, a yoga studio, mortgage broker, hair salon, nail salon, model train store, Casco Bay Home Care, which provides services for people requiring care in their homes — it's a wide-ranging group of people serving the community," said Buzzy Trusiani.

Other tenants include Funeral Alternatives, Music Together of Greater Portland and Impawsible Impressions Dog Salon.

Cardente will manage the property with Trusiani's assistance.

The Yarmouth property consists of a dozen units ranging from 700 square feet to 12,000 square feet, and is almost fully tenanted, with one unit currently available.

"What's nice is the diversity and scale of the property," said Trusiani. "It's an inviting place for smaller businesses to get established in a small community like Yarmouth. One of the reasons we're excited about being part of the Yarmouth community is that we've lived in Cumberland and Falmouth all our lives, so we're familiar with Yarmouth. And we're excited about Yarmouth's future."

Cardente Real Estate: Through The Years.. A Decade and Counting

In 2015, Cardente Real Estate celebrated its 10-year anniversary. A full-service real estate & investment brokerage out of Portland,

the company specializes in all aspects of the sale and leasing of commercial real estate throughout

Maine and New Hampshire. Starting out as a “small shop” brokerage, the company grew into a leader in the industry, with six commercial brokers, an “in-house” Architectural Designer & Sales Agent, and support staff. The company’s full-service commercial management division, Cardente Property Management, was founded in 2007.

In the summer of 2005, Cardente Real Estate was created by Matthew Cardente to provide clients with a better alternative to their commercial real estate needs. For five years prior, Cardente worked at CBRE|The Boulos Company, starting as an intern and departing as a commercial broker.

“I learned a lot from Joe Boulos and his team,” Cardente re- flects. “But with time comes change.”

Cardente Real Estate opened in 800 square feet of open office space next to World Gym at 34 Diamond St. in Portland. Owned by Cardente’s father, Douglas, the warehouse/office building was once occupied by Portland Transmission, established by Douglas and his father, Thomas.

“My brother Michael acted as the initial General Manager and my father shared office space with us,” says Cardente. “I was in my 20s and thoroughly enjoyed starting what was supposed to be a very small business.”

Cardente received a call from Joe Malone of Malone Commercial Brokers shortly after opening.

“Joe called to congratulate me on my new endeavor, and said to call him if I ever needed help. That meant a lot to me, coming from somebody so well-established.”

The initial vision was to be a one- to two-broker company. But the “small shop” concept quickly changed. Greg Perry became the first broker to join, six months after the company’s creation. Shortly after, Karen Rich, a leading commercial broker in Maine since the 1990s, came onboard.

“I was in absolute shock, at the time, that Karen Rich came on- board,” says Cardente. “She was a big name in Maine commercial brokerage. One second, I’m hustling to get a couple of listings. The next, we have three brokers, a general manager, an administrative assistant, and my father, all in 800 square feet of cubicles.”

To accommodate expansion, in 2006, Cardente moved to a 2,200-square-foot retail unit, primarily funded by an equity line Matthew took out on personal property. Located at 299 Forest Ave., Portland, the new location provided onsite parking, space for future growth and, most importantly, highly visible signage to market the name.

“We always talk about the importance of having signage on properties we market for lease and sale,” says Perry, now Partner and Senior Broker. “It seemed like a good idea to have a big sign on Route 302 to promote our name.”

The next three years were significant for Cardente’s growth and market share.

Major transactions included:

• Rich’s $4.627 million sale of Western Avenue Crossing, a 15,700-square-foot retail complex in South Portland

• Perry and Rich’s sale of 3 Eastview Parkway in Saco to Ira Rosenberg (owner of Prime Motors)

• Cardente’s $4 million sale of 482 Congress St., a 65,000-square- foot multi-tenanted office building with surface parking, owned by JB Brown & Sons

Vinny Maieta and JB Brown & Sons proved key clients. With Rich’s help, Maieta developed the Western Avenue retail cor- ridor in South Portland. JB Brown & Sons used Cardente for lease listings and the sale of their Congress Street building. They helped build Cardente’s foundation.

With the economy in recession, late 2008 through 2009 proved tough.

“We questioned every deal we had under contract,”says Partner/ Broker Michael Cardente. “Until a lease was signed, there were always reservations that things would fall apart.”

In 2009, Mark Richards, owner of The Richards Group in Vermont, used Cardente as a Buyer Representative for the purchase of 19 Northbrook Drive, a Class A office building in Falmouth. Richards then gave Cardente management of the property, then management of a Cooks Corner property in Brunswick.

“Working with Mark Richards has been a blessing since I met him,” says Matthew Cardente. “You don’t meet many people in the business world who are as smart, level-headed, humble and kind as Mark.”

Client Peter Thompson, owner and founder of Peter Thompson & Associates, also kept the company going through the tough years. Thompson writes on a Google review in March of 2016:

“I have invested in commercial and residential real estate in the Portland area for more than 20 years. Over the last 10 years, I have used Cardente Real Estate to handle several commercial and residential real estate transactions. Matthew Cardente has consistently provided excellent service, working diligently to find me properties that fit my needs and get me the best possible deals. Prior to hiring Matthew in 2006, I used other brokers in Portland, so I am able to compare the services CRE provides to those other firms. Matthew Cardente is, in my mind, the hardest working broker in town and I would recommend him highly.”

In 2010, Cardente Real Estate purchased and moved into a 2,908-square-foot office condo at 322 Fore St. in the Old Port of Portland, where the company remains today. Being near the Financial District and in the Heart of Portland opened the door to compete on a larger scale. In 2013, Rich—the Maine Commercial Association of Realtors Broker of the Year in 2012—represented the seller of 465 Congress St., Portland. The 85,000-square-foot office building and parking garage sold for $5.55 million. That year, Michael Cobb II joined Cardente after doing residential brokerage out of Gray, then became Partner in 2015.

“I think he might have made a record in commercial real es- tate when he came onboard,” says Cardente, “After telling him it would take a while to get his feet wet, within days he found a buyer for our 959 Congress St. listing, closing the $1,287,500 transaction three months later.”

In 2014, Michael Cardente teamed up with Cassidy Turley and auction.com to sell the Old Port Portfolio for $5,617,500. One of

the most significant packages in the Old Port, that sale included 50,000 square feet of retail, res- taurant, and mixed use space.

To close out 2014,both Cardente brothers joined with Turley again to sell 511 Congress St.,Portland.The 130,000-square-foot office tower and adjacent surface parking lots sold for $12.45 million. Purchased by Ed Gardner, also the Principal of Portland-based residential firm Ocean Gate Realty, Gardner re- branded 511 Congress into Ocean Gate Plaza and gave Cardente the leasing representation. As of June 2016, Ocean Gate Plaza’s vacancy rate was 3.48%, down from 9% at the time of the purchase.

“Mr. Gardner has always been meticulous with every detail of the properties he’s developed over the years,” says Cardente “With the significant changes he made to Ocean Gate Plaza, he trans- formed a notable office building on Portland’s skyline into a vibrant masterpiece that offers incredible synergy—and is now considered the Gateway to Portland’s Arts and Financial District.”

Perry—Cardente’s first Real Estate Broker of the Year, and the Maine Commercial Association of Realtors Broker of the Year for 2016—broke new sales and leasing records in recent years. Representation includes the buyer of the 88,000-square-foot Hannaford-anchored Shops of Long Bank in Kennebunk for $6.925 million.

“Greg amazes me every year,” says Cardente “He does it all, from selling large businesses that nobody knows about because of confidentiality, to coming up with our slogan, ‘Building a Foundation of Trust, One Client at a Time.’”

The firm continues to expand and find specialty services. Sarah Sausville, hired in 2014, is “in-house” Architectural Designer, cre- ating CAD plans for property owners and 3D scaled renderings and test fits for prospective tenants wanting a better “vision” of the space they are considering leasing. Sausville is now getting her Associate Broker’s license. In 2015, Mark Sandler joined Cardente as Associate Broker, after working with the Dunham Group.

Over the years, the deals, clients and advisors have made Cardente what it is today.

“My biggest influence has been my father,” Cardente says. “He has been a leading client, confidant and mentor. My brother has been loyal and selfless from the start. People don’t realize Michael worked for free for a long time, helping me get the company started.”

And for the company’s growth and success over the decade, Cardente credits the three commercial brokers who joined him at the start.

“They had faith in me then, are all still here today,” he says. “That is amazing to me, considering the ups and downs of the market during our time together. If you find a Greg Perry, Karen Rich and Michael Cardente, you can build the foundation to make a ‘small shop’ brokerage a leading firm in today’s commercial real estate market.”

East Bayside getting grant money to clean brownfield sites

PORTLAND, Maine (NEWS CENTER) --

The city of Portland hosted a bus tour of Portland's east bayside neighborhood on Thursday.

The city is trying to figure out how to distribute $200,000 in federal grant money in the neighborhood.

The money will help people who own and want to redevelop brownfield sights figure out how to do that.

East Bayside was selected as one of twenty neighborhoods in the country to get the money.

It was full of heavy industry for around a hundred years.

Some businesses owners hope they receive the grant money to continue their existing development projects.

“It will hopefully allow us to do some additional planning and try to overcome some of the obstacles that are preventing development,” said Michael Cardente, a property owner interested getting some help from the grant.

City leaders say the process of getting the sites and neighborhood fully revitalized will take time.

“We have a lot of obstacles in terms of the way it was laid out and in terms of pollutants in the ground,” said Portland Mayor Ethan Strimling. “This was really a chance for people to understand what some of those pieces are that are obstacles but also to see there are some interesting and exciting developments and ways people have turned, perhaps, some of the problems down here into real opportunities.”

Thursday's bus tour was the beginning of the process of selecting properties to invest in.

Other steps will include official city approval and community workshops.

A Historic Building at 11 Brown St.

PORTLAND — A historic building at 11 Brown St. in Maine's most populous city is on track in its conversion to luxury condominiums.

Portland developer Jack Soley paid $950,000 for the turn-of-the-century building in late 2015 as part of his mission to preserve the city's historic buildings and leverage the condo market. The site will include a ground-floor restaurant, just as the building had until the closure of Margarita's a year ago.

On May 25, Soley finalized the sale of the basement and first floor to Phelps Craig, owner of the BRGR Bar in Portsmouth, N.H. She plans her second BRGR Bar for the Portland location.

In the meantime, Soley and his nephew Dan Soley been investing approximately $1 million to redevelop the second, third and fourth floors into luxury condominiums — two units on the second floor and one 2,400-square-foot unit each on the third and fourth floors.

Since the 1930s, the top two floors had been used for storage. The building is part of what's known as the Eastman Block. Eastman Bros. & Bancroft, a major dry-goods retailer established in 1865, owned several buildings near the intersection of Brown and Congress streets, according to the Maine Historical Society, though it's not clear what the exact use of this particular building had been. The store closed in the Great Depression.

"Eastman" is inscribed in granite on the front of the building and the condos will be called the Eastman Block Condominiums.

"We're fairly far along in our conversion," said Soley. "We just started putting up sheetrock. In early July we'll start installing the final plumbing fixtures, the kitchens, flooring and finishes. We hope to be complete in late July."

The renovation will highlight the building's historic feel and features. The top three floors have ceiling heights of at least 12 feet, which will be preserved. The original huge, rough-hewn floor joists will be visible and the original hardwood flooring is being refinished.

"We'll keep the same large window openings that were originally designed with the building," said Soley. "Once that's all done, it will have a feeling almost like a New York loft space, which will be very unusual for the Portland area. These are unique units that will have lots of historic charm, tremendous ceiling height, huge windows, and a distinctly loft feeling."